-

Posts

36,185 -

Joined

-

Last visited

-

Days Won

171

Content Type

Profiles

Forums

Calendar

Gallery

Posts posted by Rich

-

-

I didn't realise lots of property was being bought by investment companies. That is so wrong. People should be entitled to buy their own home at an affordable price.

I was in North Norfolk today, we're looking to move close to Norwich and I couldn't believe the difference in price looking at the estate agent window. A 4 bedroom detached house with double garage was £325,000. Close to Norwich you're looking at around £450,000. Where we currently live you could double that! 😳

-

1

1

-

-

I completely agree. People may not have invested in property if they were getting a good return on their savings. Property values probably wouldn't have increased so much allowing more people to buy too.

Now we have lots of people with massive mortgages who's fixed rate deals have finished or will do soon, that are facing having to pay hundreds extra each month. It's easy to say well they would've been stress tested but no one could've predicted utility bills, fuel, food etc increasing in price like it has at the same time.

-

On 24/03/2024 at 21:49, adam_r said:

Hi Rich

We moved part was through a fixed term mortgage so had to take a second mortgage to bridge the gap from old house to new.

Wish I did own another property as that's where the real investment is (wrongly so). A house should be a home, not a capital investment

Gotcha! 👍🏼 Yes I agree, everyone should be able to buy a house, especially when rents are usually more than the mortgage payments.

My Dad had a second house but sold it last year after his tenant moved. He did well out of it but now interest rates have gone up he's making the same return from having the money in the bank as he was in the rent he received.

-

1

1

-

-

No change in the base rate but 8 voted to freeze and 1 reduce. So could be a sign that at the next meeting more will vote to reduce. I'd imagine a reduction will happen in the summer. Fingers crossed this encourages lenders to drop fixed rates again. Get to 4% or under and I definitely won't be hesitating to fix this time. If I had gone for the 3.89% fix I'd be saving around £150 a month now, based on the same terms.

I am still on interest only though and really want to get back on to a repayment plan but not on my current tracker. Switched to interest only as we were going to move and other bills were still high but for the last 18 months I've paid nothing off the capital. Now things have come down and I've since had a payrise I need to start overpaying it asap.

Now rates are higher I'm definitely taking more of an interest in this. When we first bought the house the 5 year fix was around 2.8% but I didn't even consider changing it when rates dropped to 1% or below. But at the time Santander didn't step down their ERC so you'd be liable for the lot if you switched products. When I looked at the ERC terms for the fixed rates they do now it says they step down.

On 22/03/2024 at 18:20, adam_r said:Seems to be a lot of weird stuff going on in the market. Lots of people seem to be selling serious volumes of shares and liquidating assets.

Some of my shares have jumped in price significantly too over the past couple of months so will be keeping a close eye on things.

I was lucky enough to clear one of my mortgages this month.. Its only been going for 13 years and I have significantly overpaid to burn it down as fast as possible.. Also helped by a significant redundancy pay back in 2021.

One mortgage left now but that's the bigger of the two now at £110k which is up for renewal soon... I keep seeing rates being pulled which is normal this close to a ~clown party~ election... But it does question what will happen!

I don't do shares, any idea why that might be happening?

Congratulations on paying one of the mortgages off, must be a relief. I assume you must rent that property out. How do you find being a landlord?

The election is likely to be after the summer isn't it. Maybe things will change as we get closer to it.

-

On 13/03/2024 at 20:44, parthiban said:

Interesting they're going up again - do you think they're getting ready for rate drops as we head towards the election?

Possibly, that would be nice. Still kicking myself I didn't go for the 3.89%. Hopefully it drops to that point again soon or lower.

See what happens on Thursday with the BoE meeting. Although fixed rate deals go by the swap rates and not the base rates so it might not have any impact. I think it'll stay on 5.25%.

-

1

1

-

-

On 08/03/2024 at 15:47, parthiban said:

Haven't looked at it in a while, have you seen rates drop any further over the last few weeks/months?

No they've gone up!

I wasn't rushing in this time as last year when the base rate kept increasing I switched to a lower tracker in a panic, then they stopped increasing the base rate, so didn't want to do anything rash this time.

A few weeks a go it was 3.89% for 5 years. Then it increased to 4.03% (which it was yesterday) but I've just looked now and it's 4.34%!! Kicking myself now, I should've fixed a few weeks a go.

I could go:

5 years for 4.49%

3 years for 4.74%

2 years for 4.89%

All of these are fee free. The £999 fee ones are only 0.25% less so it's cheaper to take the fix without a fee. A 5 year fix at that rate doesn't seem worth going for now.

It doesn't look like the BoE will lower the base rate until the end of 2024. So I either stick it out on my 5.59% tracker, fix at a higher rate now or wait and see if they drop again but there's every chance they could rise too.

-

Well the budget was a bit crap! Nothing for home owners.

I wonder if this will encourage lenders to drop fixed rate deals some more to get the housing market moving again. Another 2 weeks until they review the base rate again.

I also had a look at the offers in my Santander account and under ERC it says this will step down over the term. I'm certain that's a new thing, I don't recall seeing it before

-

For such a large company I'm amazed they haven't even put a Protyre sign up. It's still the same logos for Blackboots and WIM.

Reading reviews some people also say they've been using them for years and how good they are. Yet they've only owned it for 2 years and the whole workforce that made BB/WIM are no longer there.

-

I had to go to Screwfix after work so drove along to the garage to see if they had replaced any of the signage. Guess what, they haven't! WIM signs are still up.

As WIM was run under Blackboots and they purchased it from them I guess they aren't doing anything illegal like trading under false pretences. Although there is nothing to say it's actually Protyre there.

-

1

1

-

-

With Santander I believe it is the same, they don't reduce it like other lenders but it's something I would check first.

I'm not rushing into a fixed deal and will be taking my time to decide. I'm not sure if I want to wait until the second half of the year when the election is likely to be called. Who knows what will happen in the run-up to it, maybe lenders will keep dropping fixed deals but it's all a risk.

-

Yes we'll be buying another house but the whole idea of moving to another area is to reduce the mortgage as well as getting a larger property. Depending on the house and area we could reduce the mortgage by quite a bit and with a 5% ERC on what we don't need could be costly. That's assuming Santander allow us to port the mortgage but it should be ok.

The base rate announcement was interesting. Out of 9 votes, 6 of them wanted it kept the same, 2 an increase and 1 a decrease. I can't see it dropping by more than 0.5% by the end of 2024 and more drops in 2025. Say it hits 3.5% towards the end of 2025 that would make our tracker the same as the 5 year fix I can get now. In that time I would've paid out hundreds/thousands more in interest. Although this would obviously decrease as the base rate drops.

The only benefit I can see for staying on the tracker now is if fixed rate deals get any cheaper but they could just as easily increase and then I'll wish I had fixed sooner!

Work has also thrown a curveball. It looks like from April all non teaching staff are getting a substantial payrise, much more than the usual 5% increase. I wouldn't be able to get a similar job in Norfolk that pays the same. The only way would be getting in to one of the universities but that could take a while waiting for the right jobs to come up. I'm keen to stay in education so have only been looking in this industry. This was only announced yesterday but I'm now thinking of staying put a little longer which makes the 5 year fix even more appealing, especially if I'm paying another £999 fee.

-

On 19/01/2024 at 19:04, adam_r said:

It will be interesting how the rate fluctuating will impact people. I am due to renew mine shortly and am wincing at the new repayment costs. I don't have a badly paid job but I do wonder how those less fortune can cope.

Food prices are crazy high, car and house insurance is jumped up... Doesn't leave much left in the kitty at the end of the month.

Yeah some people are really struggling. I've been reading various posts, especially on MSE and it's eyewatering how much some mortgages are going up by.

I was fortunate that home and car insurance was renewed in September and October last year. I'm not looking forward to the renewals this year.

6 hours ago, parthiban said:True, 3.89% is a decent rate and it's unlikely to go back to how it was - I'd maybe wait a month to see what happens and then fix at the lowest rate available then.

I did hear that Santander have bucked the trend and are increasing rates, so it's possible this rate war won't last forever.

If I had no plans to move then I would fix today at that rate for 5 years. But when we do move the ERC will wipe out all savings made from the lower rate.

It sounds like the base rate won't be dropping much this year. Even Martin Lewis on last night's show thinks it'll settle around 3% by the end of 2025. If I've remembered that right. By then our tracker would've finished.

We're actually with Santander but the increase is only minimal. It's not actually been increased on my offers yet. I will see what happens with the base rate first on 1st February before making a decision but I think I'm heading towards a 2 year fix now.

-

I know they'll be meeting on 1st February to discuss the base rate so I won't be doing anything until then. As you say it's unlikely to increase now inflation is much lower. I can hold out for now, I was just thinking that £80+ is better in my pocket than going on interest, especially the 2 year fix with no fee.

I probably won't do a 5 year fix but 3.89% seems very good compared to 2023. It's unlikely to drop back to what they used to be but how much lower do we think it might go. I can't see it being under 3% for a very long time.

Houses don't come up for sale that often in my area. Most extend or rebuild them so it's difficult to see if anything is selling. There's been lots of reductions in Norfolk though so that area is obviously being affected.

-

I'm not sure if anyone follows rates ATM but there seems to have been some big drops in fixed ones.

I'm currently on a 5.59% tracker and it doesn't look like the base rate will drop until after the summer. Even then it'll probably be a small decrease. So I'm now thinking about fixing the mortgage.

2 years with no fee is 4.69%

2 years with a £999 fee is 4.44%

5 years with a £999 fee is 3.89%

The above would save between £80-£150 a month depending on what I went for. Or I chance waiting a bit longer to see if they drop any more. I've already added £2k to the mortgage switching products in the last 18 months so I need to think carefully!

There's no point going for the 2 year fix with the fee as the difference a month without it is less than half the fee over a 24 months period.

The 5 year fix is tempting as that'll save the most and the extra saving would cover the fee after 14 months. But we are still planning on moving. It won't be until next year at the earliest, maybe even the year after. With the 5 year fix there would be a 5% ERC if it can't be ported, which I need to find out about. So it's either pay that ERC when we move (if we need to) and reduce our repayments now or stick with the 2 year.

I really can't see the base rate dropping below 5% this year so it doesn't make sense to stay on the tracker now.

Anyone work in banking, got any predictions! 😂

-

Just came across this video, they really did take a battering last week! You may want to fast forward through it.

The houses on stilts at the start of the video have been given 7 days to move out before they're pulled down. One of them (dark blue) has only just been completely renovated. Personally I think that was a silly thing to do but they're stripping the whole house now.

This end of the road was actually eroding slower than the other end and no one expected them to lose the amount they did. You can see on Google maps the one that was being renovated (no roof) and how much dune was still left.

The problem now is the brick houses are directly behind them and there are hundreds at risk. Surely the government will fund the defences before it gets that far. The cleanup operation and rehousing everyone will cost much more than the defences will.

-

1

1

-

-

Yes I'll do that next year, it's coming off the road now for winter.

The Accord isn't too bad mechanically. The auto box can be a bit iffy sometimes in full auto mode, I drive it in semi mode. It's running a bit rich I think, smokes in the morning and you can smell it. The rear sill is badly rusted and would probably get advised soon. So I think it'll be going.

-

2 hours ago, eddie said:

the welding was done by the body shop behind the takeaways on uxbridge road - looks like a decent job

That's good to know, I was going to get a quote from them for respraying the bonnet on the MX5. Did you go down there or phone? I can only find a phone number for them, they seem pretty old school when it comes to advertising. They do seem to get a lot of trade by word of mouth though.

It's probably not worth getting the Accord repaired but if the MX5 ever needs more welding I might use them.

-

11 hours ago, Geoffers said:

Absolutely heartbreaking.

You can see how the rocks have really helped delay the erosion.The rocks were donated from one of the holiday sites in nearby Gorleston that they used on the beach. They clearly work but it was pointless just putting those down and not adding to them. Unfortunately the council won't find any defences so everyone has just been left to it. I feel the council will be issuing eviction notices soon with no road access. Winter hasn't even started so this will only get worse.

It's a crazy decision not to find defences when the village generates £80 million a year from tourists. The defences would cost £20 million, yet they've just wasted £120 million building a new (3rd) bridge and nearly £5 million on a new market in the town which everyone hates!

-

They got hit bad last night, the road has now gone so no vehicle access to the houses the other side of where the dunes were. I wonder if they'll make a new temporary road but it seems a bit pointless to me.

-

We ate at the Italian, it was good food.

-

-

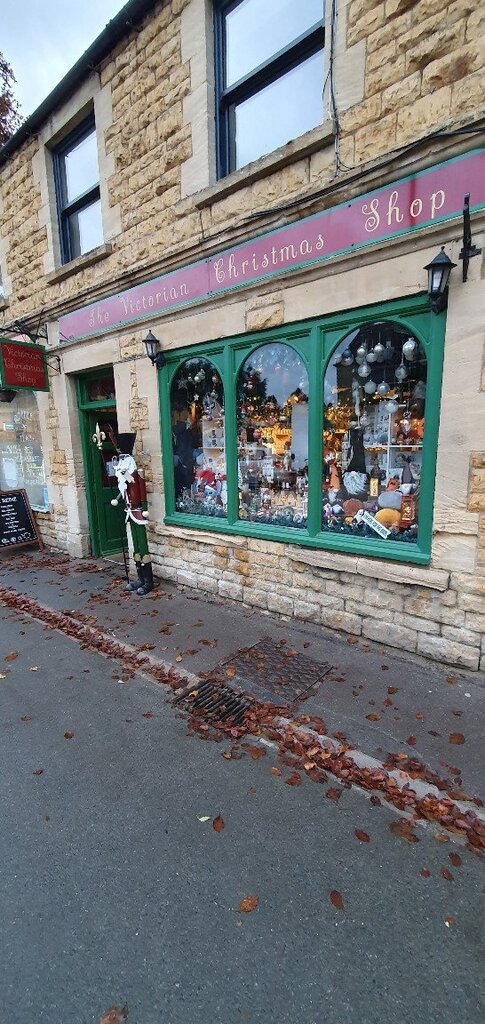

I'm definitely going to do some day trips there, Bourton on the Water is 90 minutes away and we'd like to spend the day there when the weather is nice. The only time I've been to the Cotswolds before is driving through it on the M4!

I was amazed to see a proper Christmas shop there, I didn't even know they existed but they must do good trade to be open from April to Christmas Eve.

We didn't see many people where we were staying but everyone was very friendly. Much more so than where we live. Hopefully it stays that way.

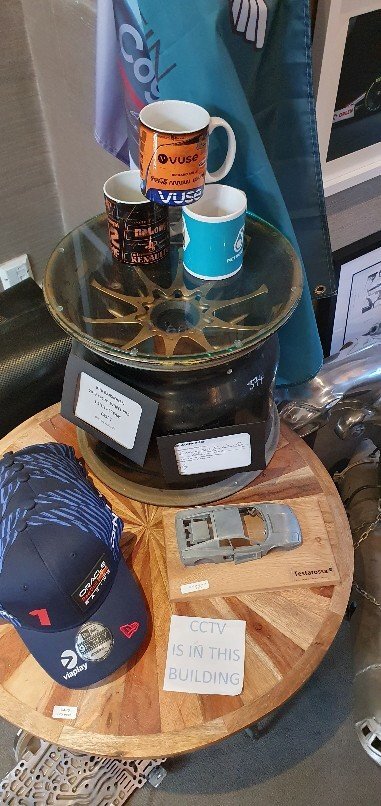

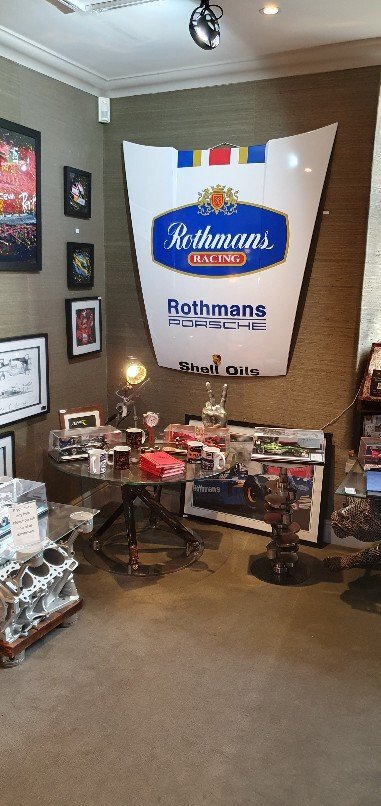

Wish I had a spare £3k for that Kimi Raikkonen rim. Would look great on a table or shelf. The horse was made from scrapped car parts and is £10k to buy! 😐

-

Some photos from our holiday to the Cotswolds a couple of weeks a go. First time there and it's a lovely area, will definitely return. We stayed in a cottage in Ebrington and visited Broadway, Bourton on the Water and Warwick Castle on the way home.

The cottage was on a working farm and they have this helipad on it. It does still get occasional use too!

The Man Cave in Broadway. Very expensive!!

Bourton on the Water

Warwick Castle

-

Looks like they've got the Hawkeye. Makes sense as that's the one Tony trained him on. Glad the car is handling much better now.

Yeah the dog is really lovely 👍🏼

-

1

1

-

Tracker or Fixed mortgage

in Insurance & Legal Discussions

Posted

Seems some providers are increasing fixed rates again!

I have no idea what to do now. I can take 4.46% for 5 years, which is 1.17% less than my current tracker but once I accept it I can't change to a lower rate penalty free. It could take a year for the BoE to drop the base rate by 1%, that's if it even goes that low.

Will find out what my exact payrise will be next week so can then make a decision.