-

Posts

4,207 -

Joined

-

Last visited

-

Days Won

69

adam_r last won the day on January 20

adam_r had the most liked content!

About adam_r

- Birthday 03/08/1986

Previous Fields

-

Vehicle

Honda Accord 2.2 I-CDTI

Profile Information

-

Gender

Male

-

Location

Wimborne

adam_r's Achievements

-

Hi Rich We moved part was through a fixed term mortgage so had to take a second mortgage to bridge the gap from old house to new. Wish I did own another property as that's where the real investment is (wrongly so). A house should be a home, not a capital investment

-

Seems to be a lot of weird stuff going on in the market. Lots of people seem to be selling serious volumes of shares and liquidating assets. Some of my shares have jumped in price significantly too over the past couple of months so will be keeping a close eye on things. I was lucky enough to clear one of my mortgages this month.. Its only been going for 13 years and I have significantly overpaid to burn it down as fast as possible.. Also helped by a significant redundancy pay back in 2021. One mortgage left now but that's the bigger of the two now at £110k which is up for renewal soon... I keep seeing rates being pulled which is normal this close to a ~clown party~ election... But it does question what will happen!

-

It will be interesting how the rate fluctuating will impact people. I am due to renew mine shortly and am wincing at the new repayment costs. I don't have a badly paid job but I do wonder how those less fortune can cope. Food prices are crazy high, car and house insurance is jumped up... Doesn't leave much left in the kitty at the end of the month.

-

Desiccant bags work very well, but they need to be dried out fairly frequently via an oven or other heat source to remove the absorbed moisture. I can guarantee that if you use salt, you will cry next spring with the corrosion

-

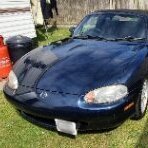

Mazda still don't have great rust proofing, never have. The newer Toyotas look very nice... And it's a Toyota it will just keep on going!

-

Don't use salt! Mx-5 will rot even faster! Really worthwhile buying desiccant bags as they won't promote rot

-

Worth seeing is you can buy some desiccant bags and putting them in the car to remove some of the residual moisture

-

17s are the smallest but they also do 18s and 19s. If you engage cruise control it does some weird stuff with the timing and fuel injection which massively improves fuel economy. At 60-65mph I can easily get 57mpg on a flat road. Wish I had spent the extra on a newer face-lift model as they have a better infotainment system. Mazda is nice, but I would look at a Toyota estate if I where to buy again

-

Ah as its the auto that makes sense! I had a 2.2 diesel, then a 2.0 petrol The diesel way great but with the remap I had (200hp up from 140) the DMF was starting to go and didn't want to spend the 1.5k on a new DMF and clutch. So removed the map, sold the car and got a 2.0 petrol for £2k. Bullet proof the 7th gen accords, really wish they didn't cease production at the 8th gen. Such a fantastic motor and a very engaging drive!

-

Well little update on this as its almost been a year now. Had it serviced and MOTd, £300 all in but it maintains its DFSH. Currently averaging around 40mpg with mainly town commute, achieving mid 50's when on a considerate motorway cruise. At 70+ a few percent, mpg drops and I get about 35-38 which isn't awful. At 8k miles so far this year petrol still seems the sensible option. Tryes are silly prices due to the factory 19" wheels, so had to opt for some mid range tyres for £160 each.

-

Oh dear! Could you use some bonding glue as a fix or are you going to see if you can get it fixed by a soft top specialist?

-

21mpg seems very low for the 2.0 petrol Rich. My old saloon got ~35mpg round town and could stretch to 48mph on a motorway run

-

Nationwide are fixing for 10 years at 4.89% if you pay the £1000 product fee

-

I would not, as soon as they know you want to leave they will start looking for a replacement. It will also complicate matters in work. Best use holiday / sick day to attend interviews

-

Chiming in late here... If you can afford the product fee, pay it upfront and don't 'pay for it' by accepting a higher interest rate. One thing I would encourage is to go and search how to calculate compound interest. Then use excel to provide you a burn down of your mortgage. You will be surprised at how much overpaying or taking on a shorter mortgage term will help you pay off your mortgage that much earlier!